Labour Costs: Who is the Outlier?

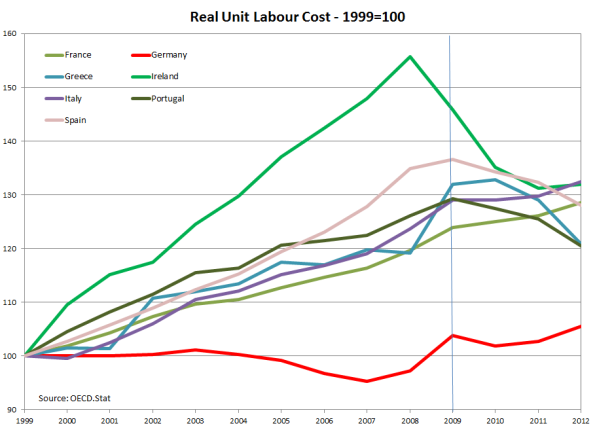

Spain is today the new model, together with Germany of course, for policy makers in Italy and France. A strange model indeed, but this is not my point here. The conventional wisdom, as usual, almost impossible to eradicate, states that Spain is growing because it implemented serious structural reforms that reduced labour costs and increased competitiveness. A few laggards (in particular Italy and France) stubbornly refuse to do the same, thus hampering recovery across the eurozone. The argument is usually supported by a figure like this

And in fact, it is evident from the figure that all peripheral countries diverged from the benchmark, Germany, and that since 2008-09 all of them but France and Italy have cut their labour costs significantly. Was it costly? Yes. Could convergence have made easier by higher inflation and wage growth in Germany, avoiding deflationary policies in the periphery? Once again, yes. It remains true, claims the conventional wisdom, that all countries in crisis have undergone a painful and necessary adjustment. Italy and France should therefore also be brave and join the herd.

Think again. What if we zoom out, and we add a few lines to the figure? From the same dataset (OECD. Productivity and ULC By Main Economic Activity) we obtain this:

It is unreadable, I know. And I did it on purpose. The PIIGS lines (and France) are now indistinguishable from other OECD countries, including the US. In fact the only line that is clearly visible is the dotted one, Germany, that stands as the exception. Actually no, it was beaten by deflation-struck Japan. As I am a nice guy, here is a more readable figure:

The figure shows the difference between change in labour costs in a given country, and the change in Germany (from 1999 to 2007). labour costs in OECD economies increased 14% more than in Germany. In the US, they increased 19% more, like in France, and slightly better than in virtuous Netherlands or Finland. Not only Japan (hardly a model) is the only country doing “better” than Germany. But second best performers (Israel, Austria and Estonia) had labour costs increase 7-8% more than in Germany.

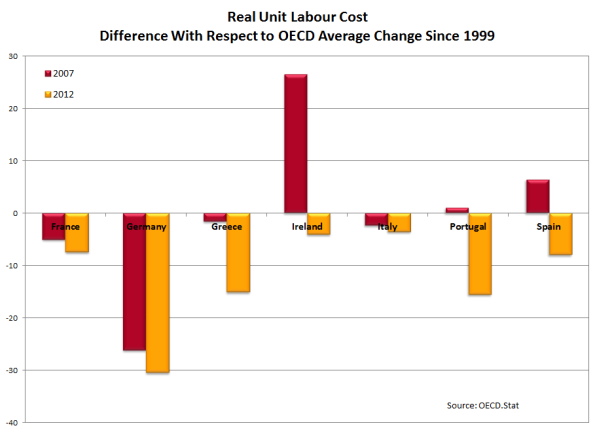

Thus, the comparison with Germany is misleading. You should never compare yourself with an outlier! If we compare European peripheral countries with the OECD average, we obtain the following (for 2007 and 2012, the latest available year in OECD.Stat)

If we take the OECD average as a benchmark, Ireland and Spain were outliers in 2007, as much as Germany; And while since then they reverted to the mean, Germany walked even farther away. It is interesting to notice that unreformable France, the sick man of Europe, had its labour costs increase slightly less than OECD average.

Of course, most of the countries I considered when zooming out have floating exchange rates, so that they can compensate the change in relative labour costs through exchange rate variation. This is not an option for EMU countries. But this means that it is even more important that the one country creating the imbalances, the outlier, puts its house in order. If only Germany had followed the European average, it would have labour costs 20% higher than their current level. There is no need to say how much easier would adjustment have been, for crisis countries. Instead, Germany managed to impose its model to the rest of the continent, dragging the eurozone on the brink of deflation.

What is enraging is that it needed not be that way.

mi piace molto il grafico giallorosso. 😀

LikeLike

Since the Eurozone (ECB) has an explicit inflation target of 2% you can just assume that the ‘correct’ nominal ULC growth rate is 2% in the long run. Such a policy was actually achieved by France while obviously the overshooting of the periphery compared to such a metric is much lower:

LikeLike

indeed, the real sick man in Europe is still Germany. It’s just that they can export the symptoms to the rest, because they effectively control monetary and economic policy in Europe.

LikeLike

One further observation on this issue of real exchange rates is that, in the short run at least, it is a zero sum game: what one country gains from greater competitiveness is what another country loses from lower competitiveness. All countries cannot win at this game simultaneously… unless they all export to another planet which would not be of our concern? Finally, this also highlights that export-oriented growth strategies tend to make an exporting country fragile and dependent, by tying its growth to other countries’ domestic demand. Better to achieve real GDP growth based on one’s own final domestic demand.

LikeLike

Reblogged this on lbiagini.

LikeLike

What about the productivity of labour? Or simplier, why not taking into consideration the growth of GDP in the same period? Hungary, Estonia, Slovenia had higher unit labour cost growth in 1999-2007 than Italy? Sure, but what was theGDP growth in these countries? Surely Itay’s productivity whould lagged far behind

LikeLike

Unit Labor Cost factors in productivity already in its definition. It is the cost of producing one unit of output. Two countries can have the same unit labor cost if one produces 10 units paying 10 Euro/hr while the other produces 20 units paying 20 Euro/hr gives the exact same Unit Labor Cost. One is twice as productive as the other. Or one country doubles productivity and pay and retains the exact same Unit Labor Cost.

Hungary Estonia, and Slovenia’s growth in productivity would reduces what would have been even faster growth in Unit Labor Costs. Their wages went up faster than productivity. Unit Labor Costs can fall if productivity rises faster than wages.

LikeLike

I’d like to see those labour costs compared to Asian countries.

LikeLike

Asian countries, except Japan, went up faster than Germany’s labour cost. Korea is in the graph (as it is an OECD member).

LikeLike

Great post. By the way analysts never seem to remember comparing actual ULC; they always focus on the change versus a starting date. If Spain wants to ever catch up with Germany’s living standards then obviously ULC have to grow more rapidly, which is admisible as long as productivity alse increases at a faster rate. But it is my understanding that Germany’s productivity performance has not been brilliant.

LikeLike

You are easy to enrage.

You seem to think that convergence is an end in itself. Ever heard of competition?

“There is no need to say how much easier would adjustment have been, for crisis countries.”

Yes, you need to explain that. Would crisis countries have exported enough to avoid their crisis if Germany had been more expensive? That would mean that they were in competition with Germany. But Germany cannot compete with Greece – olives, sunny beaches, classical ruins…

The crises were either based on excessive public expenditure (Greece) or consumers and firms going too deeply into debt (“balance sheet recession”). How would it have helped crisis countries if Germany’s wages had been higher? Would that have helped enough?

I sincerely hope you do not believe that. But I stronglysuspect you do.

Let me hear from you.

LikeLike

Greece exports sunny beaches and vacations through tourists. They don’t have to be Germans. Germany is a huge drag on Europe and especially the Eurozone as there is no way to make anything from other Eurozone countries more attractive to Germans. German austerity makes the Greek vacation relatively more expensive and less common. Germany is quite the outlier and is a major cause for massive unemployment in the rest of the Eurozone.

Your competition notion is non-sense. Read Ricardo,

LikeLike

You’re just being snarky. You choose “olives” but ignore all the other categories where there is, indeed, competition. Aluminum. Steel. Tobacco. Prepared foods. Pork. Beef. Alcoholic beverages. Coffee. Pastries. Yes, Germany and Greece DO compete, and sometimes the categories are fungible, meaning if German prices were too high, consumers would make an alternate choice.

Did Greece do bad things? Yes. Is Germany doing bad things now by dictating how every other Euro nation should run its economy? Yes. I sincerely believe you do not believe that, but I have hope that someday you might.

LikeLike

Is Germany on its way to f*cking Europe yet again?

LikeLike

I have a dream: Unites States of Europe, without Germany.

Last week German heay pressure on the new Greek Government to have immediately their money back showed that Germany havo two Gods: Money and Nationalism.

Nationalisn is also confirmed to the Pegida movement and the Altertive für Deutschland party, both with the same ideology which brought Germany already once to a catastrophe, but the germa government and also the SPD party are undestimating thei danger saying thet they are a minority without importance: the same words as with Hitler in the 1930.

Germany acts as the European leader, imposing thei rules to all other partners, with the collaburation of the Eurocrats headed by Mr Juncker.

Summing all considerations with my believe that EU did its time, I wonder a Unites States of Europe, but without Germany, otherrwise they will pretend to rule.

LikeLike

what puzzles me is the political sustainability for the germany side: how and why workers accepted such a stagnation in unit labor cost? didn’t they see their purchasing power eroded in those years?

LikeLike

These reforms were done by the labour party (SPD) and the greens and were highly controversial when implemented, but organized labour lost and what you see are basically the afterpains of the new competitive/no-slouch reality in Germany established back in the late 90s and early 2000s.

LikeLike

They did see it, but Germans make no strikes and they are political idiots (I am a German)

LikeLike