Archive

Could Central Banks do More during the Crisis?

I rarely disagree with Martin Sandbu’s Free Lunch. But today’s piece on central banks is one of these cases.

In short, Martin argues that while the main culprit for the slow recovery is fiscal policy, almost everywhere too timid if not outright procyclical (we are all on board on that!), the mistakes of fiscal authorities do not exempt central banks from bearing part of the responsibility. In particular, he dismisses the claim that it was technically impossible to lower long-term interest rates further, and/or bring policy rates even more into negative territory.

I agree with this point. Interest rates could have been lowered further. Nevertheless, I think that this would have made very little difference, because after 2008 central banks were essentially pushing on a string. This point of disagreement between us can be traced to a different view about what is the liquidity trap.

I recently published a book, La Scienza inutile (a general public account of a century of debates in macroeconomics. For the moment it is in Italian and in French, English translation in progress), in which I discuss the different notions of liquidity trap. Here is the quote (sorry, a bit too long):

The first source of trouble that Keynes considers is the most extreme, the so-called liquidity trap: `There is the possibility, […] that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest’ (Keynes 1936, p.207). In slightly more technical terms, the interest elasticity of money demand is near-infinite: no matter how much liquidity the central bank injects into the economy, it is entirely hoarded by agents and hence it leaks out of the system in its entirety. Monetary expansion is not effective in lowering interest rates.

There may be different reasons why the economy enters a liquidity trap. Keynes argued, by looking at the great depression, that this usually happens at very low (but not necessarily nil) levels of the interest rate, because in this case agents would expect interest rates to rise in the future and thus would be willing to hold any extra amount of money and postpone the purchase of bonds to the moment when interest rates will be up again. More recently the liquidity trap has been defined as a situation in which the interest rate that equates savings and investment is negative, and therefore cannot be attained by the central bank (the so-called Zero Lower Bound, or ZLB; see e.g. Krugman 2000). This latter definition leaves some room for monetary policy effectiveness: if the central bank manages to trigger the expectation of positive inflation, the real interest rate (the nominal interest rate minus the inflation rate) will become negative and lead to the full employment equilibrium.

So, if we think in terms of ZLB, it exists a real interest rate at which the output gap would be closed. If that interest rate is negative, then it is harder to reach, as central banks need to raise inflation expectations and try to push short term rates as much as possible in negative territory, which requires boldness and creativity (we have seen this). But, once again I agree with Martin on that, this can be done. If instead private expenditure becomes irresponsive to interest rates, the ‘Keynes definition’, then there is little central banks could do. I had noticed, back in 2016, that while it succeeded in easing credit conditions, EMU Quantitative Easing seemed to have done little to boost confidence and expected demand (the ultimate driver of firm’s credit needs). The EMU most recent Bank Lending Survey seems to confirm the prediction of the time. Both chart 4 (enterprises) and chart 12 (households) depict a flat demand for loans, that picks up only when the EMU economic outlook brightens.

This is by no means hard evidence (I am not aware of any papers thoroughly investigating the impact of QE on credit demand). But stylized facts seem to acquit central bankers.

ps

The two works cited in the quote:

Keynes, J. M. (1936). The General Theory of Employment, Interest, and Money. London: McMillan.

Krugman, P. (2000). Thinking About the Liquidity Trap. Journal of the Japanese and International Economies 14(4), 221–237.

Pushing on a String

Readers of this blog know that I have been skeptical on the ECB quantitative easing program.

I said many times that the eurozone economy is in a liquidity trap, and that making credit cheaper and more abundant would not be a game changer. Better than nothing, (especially for its impact on the exchange rate, the untold objective of the ECB), but certainly not a game changer.

The reason, is quite obvious. No matter how cheap credit is, if there is no demand for it from consumers and firms, the huge liquidity injections of the ECB will end up inflating some asset bubble. Trying to boost economic activity (and inflation) with QE is tantamount to pushing on a string.

I also said many times that without robust expansionary fiscal policy, recovery will at best be modest.

Two very recent ECB surveys provide strong evidence in favour of the liquidity trap narrative. The first is the latest (April 2016) Eurozone Bank Lending Survey. Here is a quote from the press release:

The net easing of banks’ overall terms and conditions on new loans continued for loans to enterprises and intensified for housing loans and consumer credit, mainly driven by a further narrowing of loan margins.

So, nothing surprising here. QE and negative rates are making so expensive for financial institutions to hold liquidity, that credit conditions keep easing.

So why do we not see economic activity and inflation pick up? The answer is on the other side of the market, credit demand. And the Survey on the Access to Finance of Enterprises in the euro area, published this week also by the ECB, provides a clear and loud answer (from p. 10):

“Finding customers” was the dominant concern for euro area SMEs in this survey period, with 27% of euro area SMEs mentioning this as their main problem, up from 25% in the previous survey round. “Access to finance” was considered the least important concern (10%, down from 11%), after “Regulation”, “Competition” and “Cost of production” (all 14%) and “Availability of skilled labour” (17%). Among SMEs, access to finance was a more important problem for micro enterprises (12%). For large enterprises, “Finding customers” (28%) was reported as the dominant concern, followed by “Availability of skilled labour” (18%) and “Competition” (17%). “Access to finance” was mentioned less frequently as an important problem for large firms (7%, unchanged from the previous round)

No need to comment, right?

Just a final and quick remark, that in my opinion deserves to be developed further: finding skilled labour seems to become harder in European countries. What if these were the first signs of a deterioration of our stock of “human capital” (horrible expression), after eight years of crisis that have reduced training, skill building, etc.?

When sooner or later the crisis will really be over, it will be worth keeping an eye on “Availability of skilled labour” for quite some time.

Tell me again that story about structural reforms enhancing potential growth?

And the Winner is (should be)…. Fiscal Policy!

So, Mario Draghi is disappointed by eurozone growth, and is ready to step up the ECB quantitative easing program. The monetary expansion apparently is not working out as planned.

Big surprise. I am afraid some people do not have access to Wikipedia. If they had, they would read, under “liquidity trap“, the following:

A liquidity trap is a situation, described in Keynesian economics, in which injections of cash into the private banking system by a central bank fail to decrease interest rates and hence make monetary policy ineffective. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war.

In a liquidity trap the propensity to hoard of the private sector becomes virtually unlimited, so that monetary policy (be it conventional or unconventional) loses traction. It is true that the age of great moderation, and three decades of almighty central bankers had made the concept fade into oblivion. But, since 2008 we were forced to reconsider the effectiveness of monetary policy at the so-called zero lower bound.Or at least we should have…

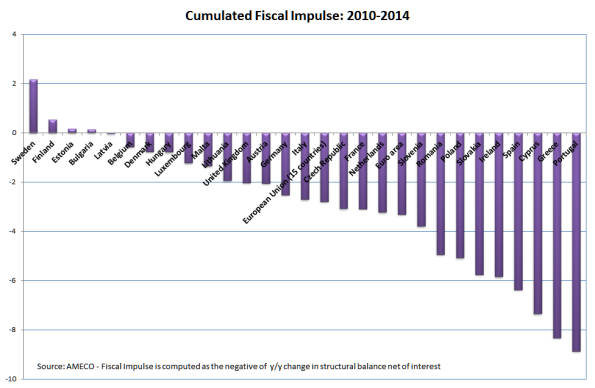

So, had policy makers taken the time to look at the history of the great depression, or at least to open the Wikipedia entry, they should have learnt that when monetary policy loses traction, the witness in lifting the economy out of the recession, needs to be taken by fiscal policy. In a liquidity trap the winner is fiscal policy. Or at least it should be. Here is a measure of the fiscal stance, computed as the change in government balance once we exclude cyclical components and interest payments.

The vast majority of E

The vast majority of EMU countries undertook a strong fiscal tightening, regardless of the actual health of their public finances. This generalized austerity, an offspring of the Berlin View, led to our double dip recession, and to further divergence in the eurozone, that would have needed coordinated, not synchronized fiscal policies. Well done guys…

And yet, Mario Draghi is surprised by the impact of QE.

ECB: Great Expectations

After the latest disappointing data on growth and indeflation in the Eurozone, all eyes are on today’s ECB meeting. Politicians and commentators speculate about the shape that QE, Eurozone edition, will take. A bold move to contrast lowflation would be welcome news, but a close look at the data suggests that the messianic expectation of the next “whatever it takes” may be misplaced.

Faced with mounting deflationary pressures, policy makers rely on the probable loosening of the monetary stance. While necessary and welcome, such loosening may not allow embarking the Eurozone on a robust growth path. The April 2014 ECB survey on bank lending confirms that, since 2011, demand for credit has been stagnant at least as much as credit conditions have been tight. Easing monetary policy may increase the supply for credit, but as long as demand remains anemic, the transmission of monetary policy to the real economy will remain limited. Since the beginning of the crisis, central banks (including the ECB) have been very effective in preventing the meltdown of the financial sector. The ECB was also pivotal, with the OMT, in providing an insurance mechanism for troubled sovereigns in 2012. But the impact of monetary policy on growth, on both sides of the Atlantic, is more controversial. This should not be a surprise, as balance sheet recessions increase the propensity to hoard of households, firms and financial institutions. We know since Keynes that in a liquidity trap monetary policy loses traction. Today, a depressed economy, stagnant income, high unemployment, uncertainty about the future, all contribute to compress private spending and demand for credit across the Eurozone, while they increase the appetite for liquidity. At the end of 2013, private spending in consumption and investment was 7% lower than in 2008 (a figure that reaches a staggering 18% for peripheral countries). Granted, radical ECB moves, like announcing a higher inflation target, could have an impact on expectations, and trigger increased spending; but these are politically unfeasible. It is not improbable, therefore, that a “simple” quantitative easing program may amount to pushing on a string. The ECB had already accomplished half a miracle, stretching its mandate to become de facto a Lender of Last Resort, and defusing speculation. It can’t be asked to do much more than this.

While monetary policy is given almost obsessive attention, there is virtually no discussion about the instrument that in a liquidity trap should be given priority: fiscal policy. The main task of countercyclical fiscal policy should be to step in to sustain economic activity when, for whatever reason, private spending falters. This is what happened in 2009, before the hasty and disastrous fiscal stance reversal that followed the Greek crisis. The result of austerity is that while in every single year since 2009 the output gap was negative, discretionary policy (defined as change in government deficit net of cyclical factors and interest payment) was restrictive. In truth, a similar pattern can be observed in the US, where nevertheless private spending recovered and hence sustained fiscal expansion was less needed. Only in Japan, fiscal policy was frankly countercyclical in the past five years.

As Larry Summers recently argued, with interest rates at all times low, the expected return of investment in infrastructures for the United States is particularly high. This is even truer for the Eurozone where, with debt at 92%, sustainability is a non-issue. Ideally the EMU should launch a vast public investment plan, for example in energetic transition projects, jointly financed by some sort of Eurobond. This is not going to happen for the opposition of Germany and a handful of other countries. A second best solution would then be for a group of countries to jointly announce that the next national budget laws will contain important (and coordinated) investment provisions , and therefore temporarily break the 3% deficit limit. France and Italy, which lately have been vocal in asking for a change in European policies, should open the way and federate as many other governments as possible. Public investment seems the only way to reverse the fiscal stance and move the Eurozone economy away from the lowflation trap. It is safe to bet that even financial markets, faced with bold action by a large number of countries, would be ready to accept a temporary deterioration of public finances in exchange for the prospects of that robust recovery that eluded the Eurozone economy since 2008. A change in fiscal policy, more than further action by the ECB, would be the real game changer for the EMU. But unfortunately, fiscal policy has become a ghost. A ghost that is haunting Europe…

Quantitative Easing and Lender of Last Resort: Lots of Confusion under the Sky

I have read an interesting article by Wolfgang Münchau, on the Financial Times. To summarize, Münchau argues that because of politician’s complacency, there is a chance that the new OMTs program launched by the ECB will never be used, and hence prove ineffective in boosting the economy. He therefore argues that the ECB should have done like the Fed, and announce an unconditional bond purchase program (private and public alike).

The piece is interesting because Münchau is at the same time right, and off the target. It is worth trying to clarify.

Be Smart, Borrow More!

Larry Summers has a very interesting piece on yesterday’s Financial Times.

He argues that a few countries (the US, Germany, Japan, the UK; I would also add France) enjoy extremely low borrowing rates, both short and long run. In particular, real rates (nominal rate minus inflation) are negative or zero for maturities up to 5 years, and extremely low for longer ones. Summers’ conclusions are then straightforward:

- Focusing on further quantitative easing is not particularly useful; given the already very low rates, further reductions are unlikely to trigger private spending (it has a name: liquidity trap. And Paul Krugman has been insisting a lot on this, for example here)

- More importantly, government should borrow now, like crazy, taking advantage of the favorable conditions to reinforce their long term fiscal sustainability. This is what any reasonable CEO would do, and there is no reason why governments should act differently.

Summers makes a point that is almost obvious: Any project that has positive expected return would improve the country’s fiscal position, if financed with debt at negative real rates: This is the time for example to borrow to buy government buildings that are currently leased. Or to accelerate the rate of replacement of aging capital; or again, to engage in long term infrastructure building/renovation. Makes sense, right? It makes so much sense, that chances are that it will not be done…

I would like to add two considerations. The first is to stress that to get private demand started, it is important that growth perspectives are stronger. Firms today do not invest, not because of borrowing costs, but because even at very low interest rates, expected demand is so low that investment is not profitable. The second is that, for Europe, increased borrowing in Germany, France and the UK would be crucial. Countries enjoying low rates could not only significantly improve their long term prospects, as Summers argues. They could also sustain demand in countries that are consolidating, thus favoring the rebalancing I have repeatedly argued for.