Mr Sinn on EMU Core Countries’ Inflation

Two weeks ago I received a request from Prof Sinn to make it known to my readers that he feels misrepresented by my post of September 29. Here is his very civilized mail, that I publish with his permission:

Dear Mr. Saraceno,

I have just become acquainted with your blog: https://fsaraceno.wordpress.com/2014/09/29/draghi-the-euro-breaker/. You misrepresent me here. In my book The Euro Trap. On Bursting Bubbles, Budgets and Beliefs, Oxford University Press 2014, and in many other writings, I advise against extreme deflation scenarios for southern Europe because of the grievous effects upon debtors. I explicitly draw the comparison with Germany in the 1929 – 1933 period. I advocate instead a mixed solution with moderate deflation in southern Europe and more inflation in northern Europe, Germany in particular. In addition, I advocate a debt conference for southern Europe and a “breathing currency union” which allows for temporary exits of those southern European countries for which the stress of an internal adjustment would be unbearable. You may also wish to consult my paper “Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem”, The World Economy 37, 2014, p. 1-1, http://onlinelibrary.wiley.com/doi/10.1111/twec.2014.37.issue-1/issuetoc, in which I also argue for more inflation in Germany to solve the Eurozone’s problem of distorted relative prices. I would be glad if you could make this response known to your readers.Sincerely yours

Hans-Werner Sinn

Professor of Economics and Public Finance

President of CESifo Group

I was swamped with end of semester duties, and I only managed to read the paper (not the book) this morning. But in spite of Mr Sinn’s polite remarks, I stand by my statement (spoiler alert: the readers will find very little new content here). True, in the paper Mr Sinn advocates some inflation in the core (look at sections 9 an 10). In particular, he argues that

What the Eurozone needs for its internal realignment is a demand-driven boom in the core countries. Such a boom would also increase wages and prices, but it would do so because of demand rather that supply effects. Such demand-driven wage and price increases would come through real and nominal income increases in the core and increasing imports from other countries, and at the same time, they would undermine the competitiveness of exports. Both effects would undoubtedly work to reduce the current account surpluses in the core and the deficits in the south.

This is a diagnosis that we share But the agreement stops around here. Where we disagree is on how to trigger the demand-driven boom. Mr Sinn expects this to happen thanks to market mechanisms, just because of the reversal of capital flows that the crisis triggered. He argues that the capital which foolishly left Germany to be invested in peripheral countries, being repatriated would trigger an investment and property boom in Germany, that would reduce German’s current account surplus. This and this alone would be needed. Not a policy of wage increases, useless, nor a fiscal expansion even more useless.

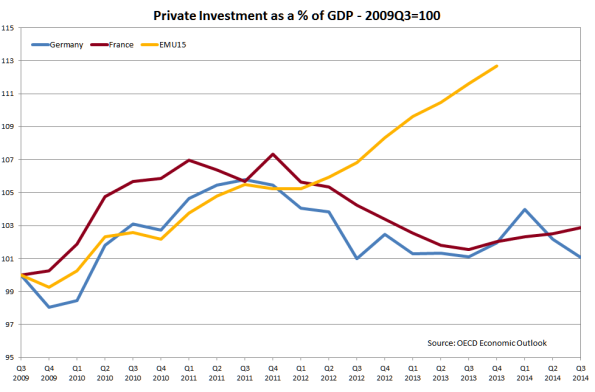

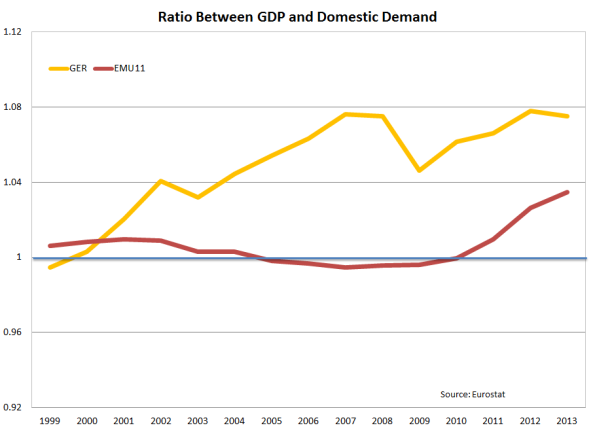

Problem is, the data speak against Mr Sinn’s belief. Since the crisis hit, capital massively left peripheral countries, and yet this did not fuel domestic demand in Germany. Last August I showed the following figure:

It shows that after a drop (in the acute phase of the financial crisis) due to a sharp decline of GDP, since 2009 domestic demand as a percentage of GDP kept decreasing, in Germany as well as in the rest of the Eurozone. The reversal of capital flows depressed demand in the periphery, but did not boost it in Germany. Mr Sinn is too skilled an economist to fail to see this. The reason is, of course, that the magic investment boom did not happen:

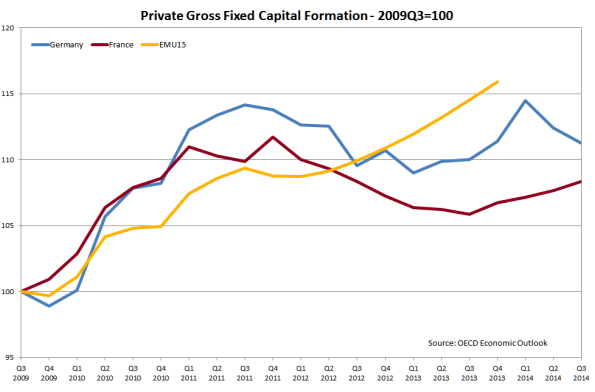

Mr Sinn, being a fine economist, could object that this is because GDP, the denominator, grew more

Mr Sinn, being a fine economist, could object that this is because GDP, the denominator, grew more fell less in Germany than in the rest of the EMU. Well, think again.

Yes, France comes out as investing (privately) less than Germany. But we are far from an investment boom in Germany as well. Mr Sinn, will agree, I ma sure.

Yes, France comes out as investing (privately) less than Germany. But we are far from an investment boom in Germany as well. Mr Sinn, will agree, I ma sure.

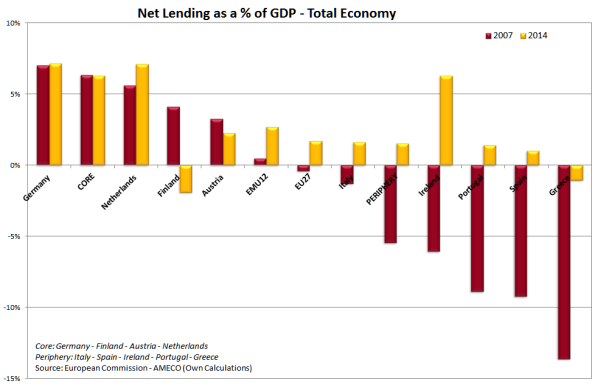

What basically happened, I said it before, is that adjustment was not symmetric. Peripheral countries reduced their excess demand, while Germany and the core did not reduce their excess savings. The result is that, if we compare 2007 to 2014, external imbalances of the periphery were greatly reduced or reversed, while with the exception of Finland the core did not do its homework:

The EMU as a whole became a large Germany, running a current account surplus (it was more or less in balance in 2007), and relying on its exports for growth. A very dubious strategy in the long run.

The EMU as a whole became a large Germany, running a current account surplus (it was more or less in balance in 2007), and relying on its exports for growth. A very dubious strategy in the long run.

The conclusion in my opinion is one and only one: We cannot count on markets alone, in the current macroeconomic situation, if we want rebalancing to take place. In the article he suggested I read, Mr Sinn states that a 4 or 5 per cent inflation rate would be politically impossible to sell to the German public:

Moreover, it is unclear whether the German population would accept being deprived of their savings. Given the devastating experiences Germany made with hyperinflation from 1914 to 1923, which in the end undermined the stability of its society, the resistance against an extended period of inflation in Germany could be as strong or even stronger than the resistance against deflation in southern Europe. After all, a rate of 4.1 per cent for German inflation for 10 years, which would be necessary to allow the necessary realignment between France and Germany without France sliding into a deflation, would mean that the German price level would increase by 50 per cent and that, in terms of domestic goods, German savers would be deprived of 33 per cent of their wealth. If the German inflation rate were even 5.5 per cent, which would be necessary to accommodate the Spanish realignment without price cuts, its price level would increase by 71 per cent over a decade and German savers would be deprived of 42 per cent of their wealth.

This shows all the logic of Ordoliberalism: It is impossible to sell inflation to the the German public, because this would deprive them of their savings. This argument only makes sense if one subscribes to the Berlin View that the bad guys in the south partied with hard earned money of northern (hard) workers. Otherwise the argument makes no sense at all, as high inflation in the core for next few years simply compensates low inflation in the past. Should I remind Mr Sinn that the outlier in terms of labour costs is not the EMU periphery, but Germany?

Also, I find it disturbing that, while acknowledging that inflation in Germany would be needed, Mr Sinn rejects it on the ground that it would be a hard sell. The role of intellectuals and academics is mostly to discuss, find solutions (or at least try), and then argue for them. All the more so if this is unpopular, because it is then that their pedagogical role is most needed. All too often public intellectuals abdicate to their role, and simply follow the trend. Should we all argue in favour of a euro breakup only because public opinion is less and less favorable to the single currency?

Finally, a short comment on another bit of Mr Sinn’s article:

And although the core countries would suffer [from high inflation], the solution would not be comfortable for the devaluating countries either. They will unavoidably face a long-lasting stagnation with rising mass unemployment and increasing hardship for the population at large. People will turn away from the European idea, and voices opting for exiting the euro will gain strength. Thus, it might be politically impossible to induce the necessary differential inflation in the Eurozone.

I don’t really see his point here. But let’s take it for good, just for the sake of argument. I think it is too late to worry about support for the euro in the periphery. It is hard to see how “excessive” inflation in the core would impose more hardness than seven years of adjustment, ill-conceived structural reforms, and self-defeating austerity.

So Mr Sinn, thank you for your mail and for the reference to your paper that I have read with interest. But no, I don’t think I misrepresented you. The core of your argument remains that the burden of adjustment should rest on the periphery’s shoulders. And you failed to convince me that this is right.

“So Mr Sinn, thank you for your mail and for the reference to your paper that I have read with interest. But no, I don’t think I misrepresented you. The core of your argument remains that the burden of adjustment should rest on the periphery’s shoulders. And you failed to convince me that this is right.”

Mr Sinn failed to convince Mr Saraceno that this is right.

Mr Sinn failed to convince me that this is POSSIBILE.

LikeLike

Great insight into the psychology of original Sinn! Has Krugman seen this?

Pery Pavilion

LikeLike

Percy, not Pery!

LikeLike

I have some doubts about the statement that now Spain and other peripherals have become new Germanies. http://chartalismo.blogspot.com.es/2014/12/desequilibrios-macroeconomicos.html

LikeLike

I find Sinn’s explanation on why inflation wouldn’t be acceptable to German savers revealing. Ultimately, it all seems to boil down to a conflict between (German) capital and (French, Italian, Spanish) labour, where the former would suffers from inflation while the latter is bearing the cost of deflation

LikeLike

Francesco:

An amusing article of December 10, 2014, in the Frankfurter Allgemeine Zeitung, Germany’s most important newspaper, quotes Angelo Bolaffi, a connaisseur of German-Italian relations:

Nowadays, Italy’s papers and intellectual elite, the intellectuals and academic teachers that used to give lectures on Adorno in Rome, consider Angela Merkel’s regulatory policy (Ordnungspolitik) to be responsible for Italy’s misery.

This seems to be confirmed by your post and two of its commenters.

There is unanimity in Germany that “that way madness lies” (Shakespeare).

Of course, that seems hard for Italians to understand. Perhaps I can refer you to Martin Wolf in the FT of December 9, 2014:

“Germany did not seek the euro. On the contrary, it was a price others foolishly asked Germans to pay for unification. German policy makers understood the political and economic implications of a currency union. Those of almost all others would-be members did not.”

Among those who pressured Germany to agree to the euro, as you can read in Timothy Garton Ash, was the Rt. Hon. Giulio Andreotti, then prime minister of Italy. A later Italian government (Prodi?) then faked its statistics to enter the euro.

Germany then adapted to the euro, others did not. So what we have today is the result of economic competition. That’s what most economists are in favour of, aren’t they? Of course, you are the exception. If you are not self-contradictory you must want to repeal the Sherman Act against Restraints of Trade and Commerce?

If there is any connection between Italy’s problems and Germany (which I doubt) then those are consequences of choices made by democratically elected Italian governments. Even the Rt. Hon. Matteo Berlurenzi (or Renzisconi?) does not appear to be making much progress.

Perhaps former prime minister Giolitti was right: It is not impossible to govern Italy, but it is senseless.

Not so long ago, the ECB published statistics which made clear that, per capita, Italians were far richer than Germans.

And then you, Francesco, think Germans should be robbed of 33 to 42 % of their savings to compensate for low inflation in the past.

What kind of a moral world are you living in?

.

LikeLike

Hanno, assume the current eurosystem could be reformed (believe me, it can) to end the crisis without inflating prices and wages in Germany, and without devaluating Germans’ credits vs the periphery.

Germany would have no problems with such a reform – is that right ?

LikeLike

Marco Cattaneo:

That would be wonderful.

LikeLike

Ms Sinn wrote:

“Moreover, it is unclear whether the German population would accept being deprived of their savings. Given the devastating experiences Germany made with hyperinflation from 1914 to 1923, which in the end undermined the stability of its society, the resistance against an extended period of inflation in Germany could be as strong or even stronger than the resistance against deflation in southern Europe.”

This argument is historically incorrect in two means:

– Not inflation undermined the stability of Germany 1914 to 1923, the war did it. Deflation destroyed the republic 1933.

– In the 1970s we had Inflation up to 7% and there was no savers rebellion, only the Bundesbank was crying.

The “resistance against an extended period of inflation in Germany” is not the resistence of the people, but the resistance of the rentiers.

So German politic sacrifices the Euro for vested interests.

LikeLike

christophgste

Yes – the vested interests of welfare recipients, pensioners, and people on low to middling salaries – their income is only revised upwards, if at all, with considerable time lags. In the meantime, inflation is “the cruellest tax” on them.

Is that so hard to understand?

LikeLike

If there is in reality any strong opposition to “high” inflation among the German population, it cannot come from any collective recollection of the Weimar hyperinflation of 1921-1924, as there are now only very few survivors from that period. It can only come from general media and pundit commentary in Germany. Hence, it should be up to the same media and pundits to explain to the German public that inflation slightly above 2% per annum, say 4%, is not a problem. What’s more, it should be recalled that the Weimar hyperinflation came about in a context of war “reparations” and the linked currency crisis, the occupation of the Ruhr, and subsequent supply difficulties in Germany. Runaway inflation is all but impossible in modern day Germany, with a properly functioning central bank.

One final note: I continue to be amazed by the incredible tolerance for economic hardship exhibited by the Greek, Spaniards, Portuguese and other citizens of the “periphery”… It must indicate that the official European ideology and discourse has been “hardwired” into the collective psyche of the peoples of Europe and that there is a great risk premium attached to ideas deviating from the official dogma. The European propaganda machine has done a great job since the early 1990s… or maybe mainstream media in Europe has done an exceptionally poor job in explaining the issues and alternatives?

LikeLike

Patrick VB

Runaway inflation is indeed unlikely. But if you have 0.2 % inflation, you don’t want that raised to 4% p.a. if you can avoid it. Are you willing to let burglars get away with it if they rob you of only 4% of your money and valuables? If so, when do you start calling for the police?

LikeLike

@ Hanno

First, I have the impression that VERY few professional economists outside Germany are calling for inflation targets below 2%, while some very prominent ones have made the case for the target to be raised to 3-4% (think O. Blanchard). Second, I would want to think about who is calling who a “burglar” or thief… And for what it’s worth, no, I wouldn’t adopt the frequent US attitude of gunning down a person (or request that he commit suicide…) for “stealing” from me… Much less so if I had “stolen” his car or house from him the day before… The thing is, hardly any prominent economist thinks that prolonged periods of deflation and recession are necessary or optimal (utility maximizing) policy responses.

LikeLike

“I would want to think about who is calling who a “burglar” or thief”.

Please continue thinking. Do you really mean welfare recipients, pensioners, and people on low to middling salaries, whose income is only revised upwards, if at all, with considerable time lags?

Economists are indeed a problem. Are Blanchard’s arguments (link, please) any better than Paul Krugman’s? He argues that inflation gives the central bank more freedom to manipulate interest rates and that workers can be hoodwinked into accepting lower real wages. I consider that to be contrary to common decency. Since morality means something to you, think about it.

LikeLike

Hanno,

Here are two links to the way some of the most respected economists of the profession (outside Germany) think about economic policy, and inflation in the current ZLB circumstances. I hope that you will find them informative…

D. Leigh: https://www.imf.org/external/pubs/ft/spn/2010/spn1003.pdf

O. Blanchard: https://www.imf.org/external/pubs/ft/wp/2014/wp1492.pdf

LikeLike

For the credibility of Blanchard collapses when he statest that governments should have had more fiscal space meaning lower public debt levels in good times. I think that by now it should be obvious to everyone that states cannot default if they are indebted in their own currency and ALWAYS have fiscal space.

LikeLike