Walls Come Tumbling Down

Yesterday I quickly commented the disappointing growth data for Germany and for the EMU as a whole, whose GDP Eurostat splendidly defines “stable”. This is bad, because the recovery is not one, and because we are increasingly dependent on the rest of the world for that growth that we should be able to generate domestically.

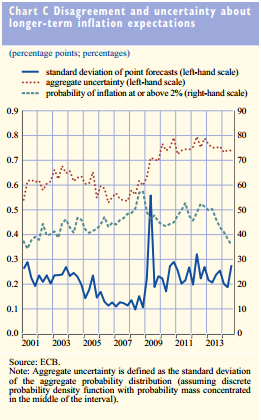

Having said that, the real bad news did not come from Eurostat, but from the August 2014 issue of the ECB monthly bulletin, published on Wednesday. Thanks to Ambrose Evans-Pritchard I noticed the following chart ( page 53):

The interesting part of the chart is the blue dotted line, showing that the forecasters’ consensus on longer term inflation sees more than a ten points drop of the probability that inflation will stay at 2% or above. Ten points in just a year. And yet, just a few pages above we can read:

According to Eurostat’s flash estimate, euro area annual HICP inflation was 0.4% in July 2014, after 0.5% in June. This reflects primarily lower energy price inflation, while the annual rates of change of the other main components of the HICP remained broadly unchanged. On the basis of current information, annual HICP inflation is expected to remain at low levels over the coming months, before increasing gradually during 2015 and 2016. Meanwhile, inflation expectations for the euro area over the medium to long term continue to be firmly anchored in line with the aim of maintaining inflation rates below, but close to, 2% (p. 42, emphasis added)

The ECB is hiding its head in the sand, but expectations, the last bastion against deflation, are obviously not firmly anchored. This can only mean that private expenditure will keep tumbling down in the next quarters. It would be foolish to hope otherwise.

So we are left with good old macroeconomic policy. I did not change my mind since my latest piece on the ECB. Even if the ECB inertia is appalling, even if their stubbornness in claiming that everything is fine (see above) is more than annoying, even if announcing mild QE measures in 2015 at the earliest is borderline criminal, it remains that I have no big faith in the capacity of monetary policy to trigger decent growth. The latest issue of the ECB bulletin also reports the results of the latest Eurozone Bank Lending Survey. They show a slow easing of credit conditions, that proceed in parallel with a pickup of credit demand from firms and households. While for some countries credit constraints may play a role in keeping private expenditure down (for example, in Italy), the overall picture for the EMU is of demand and supply proceeding in parallel. Lifting constraints to lending, in this situation, does not seem likely to boost credit and spending. It’s the liquidity trap, stupid!

The solution seems to be one, and only one: expansionary fiscal policy, meaning strong increase in government expenditure (above all for investment) in countries that can afford it (Germany, to begin with); and delayed consolidation for countries with struggling public finances. Monetary policy should accompany this fiscal boost with the commitment to maintain an expansionary stance until inflation has overshot the 2% target.

For the moment this remains a mid-summer dream…

Reblogged this on Arjen polku and commented:

This goes together well with Munchau’s piece in the FT this morning.

LikeLike

Francesco,

Not only is the discussion in Germany not “heated”, it does not happen at all.

Searching for “Wachstum Gabriel” and sorting the usual suspects by size:

1. Spiegel.de: nothing

2. Handelsblatt.com (sort of the German ft.com): one 3rd tier conservative Linnemann emphazising the need to focus more on production and less on distribution, one 2nd tier communist (equals 4th tier important for German politicians in general), Riexinger demands more social distributions, both side just uttering their standard mantras to show they have still a pulse : – )

3. faz.net : SPD retiree Müntefering demands more structural reforms, Agenda 2030, …. Pretty much the opposite you have in mind

4. suedeutsche.de nothing

5. zeit.de End of July social democrat Gabriel emphazising the need to strengthen market forces

The endless repetition of the mantra that high government debt due to excessive consumption is cured by more deficit, does not make it true

The Stability and Growth pact sets clear targets for government debt reduction (120 % GDP debt – 60% target) / 20 years requires cuts by 5% for Italy. And both Italy and France are now late by 4 years to do anything significant about it.

Starting with a cut across the whole bord of 5% of all government expense is a good start for 2014, but just a first step

LikeLike