Jean-Baptiste Hollande

le temps est venu de régler le principal problème de la France : sa production.

Oui, je dis bien sa production. Il nous faut produire plus, il nous faut produire mieux.

C’est donc sur l’offre qu’il faut agir. Sur l’offre !

Ce n’est pas contradictoire avec la demande. L’offre crée même la demande.

François Hollande – January 14, 2014

France is often pointed to as the “sick man of Europe”. Low growth, public finances in distress, increasing problems of competitiveness, a structural inability to reform its over-regulated economy. Reforms that, it goes without saying, would open the way to a new era of growth, productivity and affluence.

François Hollande has tackled the second half of his mandate subscribing to this view. In the third press conference since he became President, he outlined the main lines of intervention to revive the French economy, most notably a sharp reduction of social contributions for French firms (around € 30bn before 2017), financed by yet unspecified reductions in public spending. During the press conference, he justified this decision on the ground that growth will resume once firms start producing more. Thus, he tells us, “It is upon supply that we need to act. On supply! This is not contradictory with demand. Supply actually creates demand“. Hmmm, let me think. Supply creates demand. Where did I read this?

From the time of Say and Ricardo the classical economists have taught that supply creates its own demand; meaning by this in some significant, but not clearly defined, sense that the whole of the costs of production must necessarily be spent in the aggregate, directly or indirectly, on purchasing the product. In J. S. Mill’s Principles of Political Economy the doctrine is expressly set forth: “What constitutes the means of payment for commodities is simply commodities. Each person’s means of paying for the productions of other people consist of those which he himself possesses. All sellers are inevitably, and by the meaning of the word, buyers. Could we suddenly double the productive powers of the country, we should double the supply of commodities in every market; but we should, by the same stroke, double the purchasing power. Everybody would bring a double demand as well as supply; everybody would be able to buy twice as much, because every one would have twice as much to offer in exchange“. [Principles of Political Economy, Book III, Chap. xiv. § 2.]

Yes, this is chapter two of Keynes’ General Theory (bold is mine), where he famously challenges the (neo)classical view that price changes can generate demand capable of absorbing any level of supply.

So Hollande seems to embrace the view of his compatriot Jean-Baptiste Say that to boost growth and well-being one needs only to care about creating optimal condition for production and supply, and that demand will follow.

The theoretical discussion between neoclassical and Keynesian economists fed most of the debate in macroeconomics since the General Theory was published, in 1936. And I do not intend to open that Pandora box here. What I would like to assess is whether François Hollande is right in arguing that by lowering the tax burden of firms these will resume investing and hiring, thus triggering growth and prosperity.

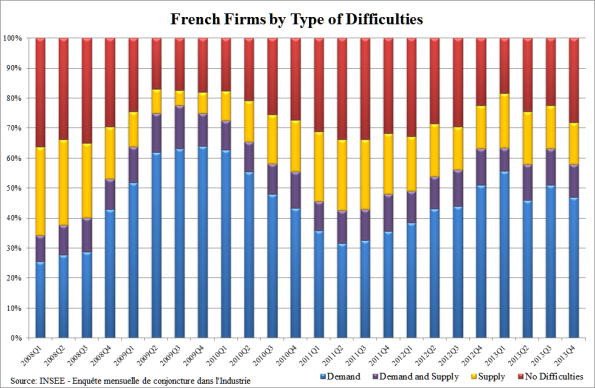

Luckily, there is an almost straightforward way to assess Hollande’s claim., thanks to an interesting quarterly survey conducted by the French Statistical Office, Insee, on economic conditions faced by firms. The survey is conducted since 1991, and surveyed firms are asked to assess their situation along a number of dimensions, including the type of difficulties they face (if any). In particular, they are asked whether their difficulties can be imputed to demand or to supply factors. And here is the result:

A number of interesting facts emerges in my opinion: First, the blue line, the number of firms facing demand problems, closely tracks the developments of the crisis: a peak in 2008-2009 along he global financial crisis, a strong improvement in 2010, and then a double-dip coinciding with the sovereign debt eurozone woes. The message seems to be clear: since the beginning of the crisis the trouble for French firms came from insufficient demand. Keynes: right; Say (and François Hollande, and the Commission, and Angela Merkel): wrong. The second interesting fact is that the ratio of firms claiming they have only supply problems (yellow) or both (purple), remains broadly unchanged along these cyclical movements. Firms move from demand difficulties to no difficulties and back, but in the past six years they did not substantially change opinion on red tape, regulation, labour costs. This means that Hollande’s measures are not likely to drastically change the mood among French firms. The recovery will only come when demand resumes. Once again, Keynes: right, Hollande and the gang: wrong. Incidentally, this picture is confirmed if we take the longer series: just look at this table:

A number of interesting facts emerges in my opinion: First, the blue line, the number of firms facing demand problems, closely tracks the developments of the crisis: a peak in 2008-2009 along he global financial crisis, a strong improvement in 2010, and then a double-dip coinciding with the sovereign debt eurozone woes. The message seems to be clear: since the beginning of the crisis the trouble for French firms came from insufficient demand. Keynes: right; Say (and François Hollande, and the Commission, and Angela Merkel): wrong. The second interesting fact is that the ratio of firms claiming they have only supply problems (yellow) or both (purple), remains broadly unchanged along these cyclical movements. Firms move from demand difficulties to no difficulties and back, but in the past six years they did not substantially change opinion on red tape, regulation, labour costs. This means that Hollande’s measures are not likely to drastically change the mood among French firms. The recovery will only come when demand resumes. Once again, Keynes: right, Hollande and the gang: wrong. Incidentally, this picture is confirmed if we take the longer series: just look at this table:

| French Firms by Type of Difficulties Period Averages |

||

|---|---|---|

| 1991-2007 | 2008-2013 | |

| Demand | 44.2 | 45.4 |

| Demand and Supply | 6.9 | 11.0 |

| Supply | 20.6 | 17.1 |

| No Difficulties | 28.4 | 26.7 |

| Source: Enquête mensuelle de conjoncture dans l’Industrie | ||

The number of firms facing supply difficulties alone or no difficulties shrank since 2008, and those facing demand difficulties (alone or together with supply) increased substantially.

Does this mean that all is well in France? Of course not. The burden on French firms, and in particular the tax wedge, is a problem for their competitiveness. Finding ways to reduce it, in principle is a good thing. The problem is the sequencing and the priorities. French firms seem to agree with me that the top priority today is to restart demand, and that doing this “will create its own supply”. Otherwise, more competitive French firms in a context of stagnating aggregate demand will only be able to export. An adoption of the German model ten years late. I already said a few times that sequencing in reforms is almost as important as the type of reforms implemented.

I am sure Hollande could do better than this…

“Supply creates its own demand” is not “Say’s Law”, although it is related to something else Say said. Basically, it means that if we “assume full employment” we can be assured of demand for the additional supply produced by the additional workers. A tautology if there ever was one. This was in an 1821 letter from Say to Malthus. See: http://ecologicalheadstand.blogspot.ca/2014/01/yasraehs-law.html

LikeLike

“I am sure Hollande could do better than this…”

I am sure he can’t.

He is from HEC university, the best business school in France, and one of the main anti Keynesian place to go. Economicly one of the worst since they hardly learn about Keynes (maybe about gold) and a lot about the “TEG”, the theory of global balance, over there.

LikeLike

As a HEC Promo 1985 (and a M.Sc. in Economics previously earned in a North American university) I can confirm you that there was NO economics curriculum whatsoever. Like with any MBA/M.Sc. Business curriculum; you only need to know how to add and subtract. To work for the French government ENA is more important than HEC but overall lying, bullying, stealing are much better qualities to succeed than solid education and strong value in the common goods. All Ivy League institutions are recruiting on that basis.

LikeLike

As a HEC graduate myself (2009), I can testify than Sailor is writing utter BS. No amount of bullying and stealing will get you past the post-‘prepa’ entry exams, where Keynesian thought is widely distilled and discussed.

And France does suffer from supply-side issues :

– at c.57% of GDP (world record I believe), public spending seems kinda capped

– even so, assuming the gvt tries to boost aggregate demand with more deficit spending (after all it can borrow long < 3%, but let's not worry about inter-generational fairness!), I gather it's safe to assume a lot will spent spent away on goods produced abroad (as French firms are not competitive – aside from the CAC40/SBF120 ones), sinking the country's current account even further

– the tax burden, red tape and fiscal incentives all align to tell the countr'ys ambitous, driven workers/entrepreneurs one thing: STOP working! Better be born rich and put in all in real estate – or go get a job in the public sector

– French companies have very low margins in general. It is not for lack of demand, but heavy taxation (mostly to care for the unproductive ones through an overly generous Securite Sociale) and a lousy position in the value chain, stuck in the middle

– therefore, imho the way to the French economy to grow its way out of its current predicament (slow decay) it needs lower taxes, better incentives, less resources shifted to the old and unproductive. This will gradually reset firms' cost structure, improve their competitiveness, restore their balance sheet and animal spirits.

LikeLike

Lelien, you are right. He can’t. He is the worst sort of political functionary timeserver. He espouses(!) privacy. So do thieves and murderers. His “partners” have nine children, four genetically his. What sort of example is this pathetic “President” of France to the children of his sex toys? Do the French people really accept his “private” life? If they do, they are in for a very, very rough ride.

LikeLike

It is very clear to me (as a French citizen) that noone really cares in France about Hollande’s private life, and when they do they see it as no more than a red herring to distract them from the very real pain he is about to inflict on our economy.

His view on the economy is not even shared by the majority of the French Socialist Party. It is mainly driven my the influence of a number of spin doctors (among them Jacques Attali, a former counsellor of president Mitterrand) and orthodox think-tanks such as Terra Nova, that advised the Socialists to forsake the working-class part of its constituency and to favor upper-middle-class types and yuppies instead.

The gap is widening everyday between a ruling class of businessmen, politics and journalists (here in France more than in other western democracies, journalists are in bed with the ruling class, owing to the fact that they all stem from the same universities, and often from the same families) and the rest of the people who feel more and more betrayed, forsaken and deceived by the corrupt bunch that they realize they have elected. Even though Sarkozy was kicked out of office 2 years ago, the economic policies remain the same, always favoring business owners, the stock market and bankers, and one has the feeling that it can only get worse.

Hence the rise of populist movements such as Le Pen’s extreme-right-wing Front National, and to a lesser extent (due to open discrimination from the journalists) Jean-Luc Mélenchon’s left-wing Parti de Gauche, which is not quite as left-leaning as Mitterrand was in 1981.

LikeLike

Keynes never refuted Say’s law. All he did was create a straw man to flail by deceptively lifting out of important context the J.S. Mill quote, and falsely claiming the straw man thus created expressly sets forth Say’s doctrine.

Let me see, where have I heard this before:

“We come now to Keynes’s famous ”refutation” of Say’s Law of Markets. All that it is necessary to say about this ”refutation” has already been said by Benjamin M. Anderson, Jr.,1 and Ludwig von Mises…The doctrine that supply creates its own demand, in other words, is based on the assumption that a proper equilibrium exists among the different kinds of production, and among prices of different products and services. And it of course assumes proper relationships between prices and costs, between prices and wage-rates. It assumes the existence of competition and free and fluid markets by which these proportions, price relations, and other equilibria will be brought about…No important economist, to my knowledge, ever made the absurd assumption (of which Keynes by implication accuses the whole classical school)…Keynes’s “refutation” of Say’s Law consists in simply ignoring this qualification…[Keynes] takes as his first target a passage from John Stuart Mill [viz., the passage contained in your quotation from the GENERAL THEORY]. By itself, this passage from Mill, as B. M. Anderson has pointed out, does not present the essentials of the modern version of Say’s Law. it is unfair to Mill to take this brief passage out of its context and present it as if it were the heart of Say’s Law. If Keynes had quoted only the three sentences immediately following, he would have introduced us to the conception of balance and proportion and equilibrium which is the heart of the doctrine—a conception which Keynes nowhere considers in his GT…Say’s Law, to repeat, was, contrary to the assertions of the Keynesians, not the cornerstone on which the great edifice of the positive doctrines of the classical economists was based. It was itself merely a refutation of an absurd belief prevailing prior to its formulation…It was Malthus who, in 1820, more than a century before Keynes, set himself to “refuting” Say’s Law. Ricardo’s an- swer (most of which was not discovered or available until recent years) is devastating. If it had been earlier available in full, it would have buried Malthus’s fallacious “refutation” forever. Even as it was, it prevented its exhumation until Keynes’s time.To sum up, Keynes’s “refutation” of Say’s Law, even if it had been successful, would not have been original: it does not go an inch beyond Malthus’s attempted refutation more than a century before him. Keynes ”refuted” Say’s Law only in a sense in which no important economist ever held it.”

These are excerpts from Henry Hazlitt’s 1959 masterpiece, THE FAILURE OF THE “NEW ECONOMICS,” AN ANALYSIS OF THE KEYNESIAN FALLACIES, Chapter III. In it Hazlitt deconstructed Keynes’ GT, chapter by chapter and line by line, showing beyond question that virtually everything novel in it pertinent to economics was wrong. In regard’s to Keynes’ so-called “refutation” of Say’s Law, Hazlitt demonstrated beyond any rational argument that Say was right and Keynes was wrong. Hazlitt followed up in 1960 by editing, THE CRITICS OF THE NEW ECONOMICS, a compendium of essays by twenty of the world’s leading debunking various aspects of Keynes’ GT. After the publication of those two books it is amazing that someone would have the temerity to cite Keynes GT on any economic issue.

LikeLike

First, let me say that I totally agree with the scientific demonstration you made, and Krugman reference to it.

Second, let me correct some of my fellows (as a graduate from Sc Po at a time when Hollande and Moscovici were sharing the teachings of a course on “advanced economics”, but also a graduate (prior to entering Sc. Po) in economics, both the President and his finance minister are competent in economics (at least in macro and finance economics, then who knows? Maybe Hollande got some ideas about micro-economy as well when he was at HEC – that is the only part of economy HEC can teach correctly).

So why do I post an answer? Because I have always felt that only this president could strike an appropriate deal with Germany (the two preceding ones failed miserably at this) the terms of which are:

I, France, will save on running the state

You, Germany, will make sure your consumers spend more

(with a quite big assumption: incremental spending in Germany benefits French production first, which worked in the past)

If you see it that way, all of a sudden, it is not as bad as Krugman thinks…

As a N.B. a lot of people confuse social transfers and public spendings, and it is interesting socially that in the 21st century, our politicians are becoming more liberal with the need to have kids, more than 70 years after 1940… Maybe people do not want to pay anymore for young women to have as many kids as they “want”? To be precise, that is the spending Hollande is cutting for the benefits of all employers, including the State and non for profit organizations!

LikeLike

NOBODY *ever* seems to ask the question “what if tax heavens did not exist, and all the money hidden there had been taxed as it should have in the first place?”… and “what if all the money lost to fraud by state representatives was still in the country’s vault?”… Around 60 or more billion euros lost to tax evasion *each year*, and still, no one seems to care, I mean, *really* care. And don’t come bitchin’ to me saying that taxes are too high and so forth. Just have a look at how wealth is spread in the USA for an example! Duh! (Short note from a frenchman who is too tired and/or lazy to develop further now…) 🙂

LikeLike

Yeah, those animal spirits really do it for me. Good policy principle, not to mention economic theory, those animal spirits. You learn that at HEC as well? Must apply next week, to get this animal spirits. Yeah.

LikeLike

Let them eat Animal Spirits?

LikeLike

Nice mainstream quoting : what kill firms are how the product of growth is distirbuted within actors, the difference of competitiveness stuck in the Euro and leveled with low incomes of households, and the high rate of savings. Creating offer when those who can buy don’t buy that’s not a good idea.

And about HEC, and whatever High level school in France in Business and Administration, Keynes may be taught but that doesn’t mean you learn from his lecture.

LikeLike

Hi, would you mind putting the link to my original post on your website? Gracias!

LikeLike