Wanted: German Inflation

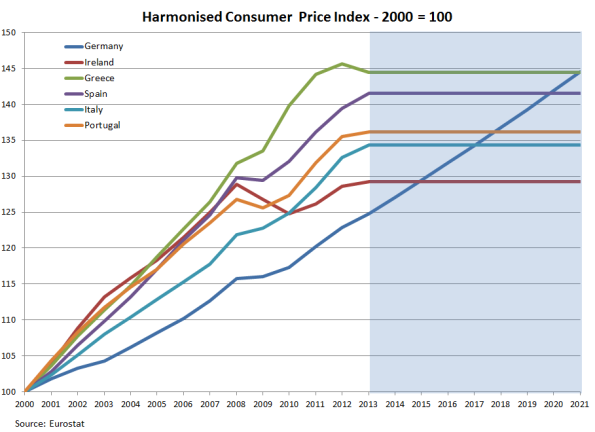

The latest Eurostat release on inflation shows that the Eurozone, and the EU at large, keep flirting with deflation. This happens mostly because peripheral countries have near-zero inflation rates. Strikingly, no EU country had, in January, annual inflation rates above the 2% ECB target (Finland and the UK stood at 1.9%). Deflation is a problem for debtors, who see the real value of their debt increase. It is a problem for macroeconomic policy (in particular monetary policy). But it is also a problem for rebalancing. The imbalances that built over the period 1999-2007 show up in diverging inflation rates and labour costs. Take the former, from Eurostat data:  I plotted CPI in Germany and in EMU peripheral countries, making 2000=100. From 2000 to 2008 all peripheral countries had higher inflation than Germany, and this led to a loss of competitiveness. The following table captures the widening of the gap in the years leading to the crisis.

I plotted CPI in Germany and in EMU peripheral countries, making 2000=100. From 2000 to 2008 all peripheral countries had higher inflation than Germany, and this led to a loss of competitiveness. The following table captures the widening of the gap in the years leading to the crisis.

| Inflation and Labour Costs Dynamics 2000-2008 | |||||||

|---|---|---|---|---|---|---|---|

| Germany | Ireland | Greece | Spain | Italy | Portugal | ||

| Average Yearly Growth (%) | CPI | 1.9 | 3.2 | 3.5 | 3.3 | 2.5 | 3.0 |

| Labour costs | 1.8 | 5.2 | 3.4 | 4.5 | 3.1 | 3.1 | |

| Differential with Germany in 2008 | CPI | 0 | 13.07 | 15.94 | 13.96 | 6.10 | 10.97 |

| Labour costs | 0 | 34.90 | 15.07 | 26.57 | 12.08 | 12.08 | |

| My calculations on Eurostat data | |||||||

Now, one may think, as I do, that the eurozone problems are due to structural imbalances, an “original sin” of the single currency; or, as the Berlin View postulates, believe that the culprit is fiscal profligacy. But in both cases, no rebalancing can happen without the gap in prices and labour costs to be somehow closed. And here begin the problems, and the differences in the diagnosis may play a role. After an initial heavy blow due to the sharp contraction of world trade in 2008-2009, Germany was capable of exploiting the world recovery thanks to its export-oriented economy. Thus it is not a surprise if it was able to dictate the rules of the game to the peripheral countries in distress. It was after all a large and relatively successful economy, a creditor of the periphery, and it was backed by EU institutions that are shaped by the neo-liberal principles that underlie the Berlin View. Thus, the burden of adjustment so far has been all but symmetric, falling exclusively on the shoulders of peripheral EMU countries. The result has been austerity, and deflation, as the figure above shows. In spite of this the differential is still remarkable, from the 5 points of Ireland, to the 20 of Greece.

So, what to do next? I used a couple of hours of a rainy afternoon to try to simulate different paths of adjustment. First I assume that all peripheral countries will have zero inflation from now onwards (the blue shaded area in the figure). I then noted the year in which Germany closes the inflation gap, depending on its average yearly inflation.

| Years to Close the Gap Assuming Zero Inflation in Periphery | |||||||

|---|---|---|---|---|---|---|---|

| Ireland | Greece | Spain | Italy | Portugal | |||

| Average German Inflation | |||||||

| 1 | 2017 | 2028 | 2026 | 2020 | 2022 | ||

| 1.2 | 2016 | 2025 | 2024 | 20219 | 2020 | ||

| 1.5 | 2015 | 2023 | 2021 | 2018 | 2019 | ||

| 2 | 2015 | 2020 | 2019 | 2017 | 2017 | ||

| 2.5 | 2014 | 2019 | 2018 | 2016 | 2017 | ||

| 3.0 | 2014 | 2018 | 2017 | 2015 | 2016 | ||

| My calculations on Eurostat data | |||||||

With German inflation rates of the magnitude of the past ones (1 to 1.5%), the gap would be mostly closed in the next decade, meaning that a country like Greece, for example would need 9-11 years of zero inflation before going back to the 1999 CPI ratio with Germany. On the other hand, which is both reassuring and enraging, if Germany were willing to accept only slightly higher inflation than the ECB target (say 2.5%), then the gap would be closed by 2019, only five years of zero inflation for Greece (and less for the others).

I then checked what average price changes would take to close the gap by 2020, once again with different hypotheses on German inflation:

| Average Yearly CPI Change to Close the Gap in 2020 | |||||||

|---|---|---|---|---|---|---|---|

| Ireland | Greece | Spain | Italy | Portugal | |||

| Average German Inflation | |||||||

| 1 | 0.50 | -1.09 | -0.80 | -0.06 | -0.25 | ||

| 1.2 | 0.69 | -0.89 | -0.61 | 0.14 | -0.05 | ||

| 1.5 | 0.99 | -0.60 | -0.31 | 0.93 | 0.74 | ||

| 2 | 1.49 | -0.11 | 0.18 | 0.93 | 0.74 | ||

| 2.5 | 1.99 | 0.38 | 0.67 | 1.43 | 1.23 | ||

| 3.0 | 2.49 | 0.87 | 1.16 | 1.92 | 1.72 | ||

| My calculations on Eurostat data | |||||||

With the exception of Ireland and Italy, with German inflation remaining on past trends, peripheral countries would need 6 years of continuous deflation, if they wanted to close the gap. And once again it would suffice a moderately higher average inflation in Germany to obtain convergence without imposing deflation to the periphery.

What lessons from this completely unscientific simulation? A simple one: convergence will not happen anytime soon with asymmetric adjustment. There is no option, really no one, that yields convergence in a reasonable time, other than German inflation climbing to a still more than reasonable 2.5-3% level.

Forget solidarity, a word that sounds increasingly vacuous in today’s Europe. Symmetric adjustments are an arithmetic necessity.

Twitter: @fsaraceno

Very good, as usual.

LikeLike

Very interesting. But imbalances can also be corrected through southern countries exporting more TO GERMANY – intermediate goods – and, so, taking advantage of the growth of german exports outside the EU

LikeLike

Would a targeted ECB asset purchase be able to cause such inflation in Germany? German assets should be about 20 % of the total for the new program, right? https://www.ecb.europa.eu/press/pr/date/2015/html/pr150122_1.en.html

Krugman thinks the total inflation expectations only raised of 0.2 % (http://krugman.blogs.nytimes.com/2015/01/22/how-super-was-mario-wonkish/ ), but maybe the actual result will be better when disaggregated?

LikeLike